FOFUND, established in 2014, stands as China's preeminent B2B independent fund distributor. Guided by the vision of "empowering asset management with technology" for over a decade, FOFUND provides institutional investors with an extensive array of OTC fund investment solutions. These encompass transaction processing, investment research, risk management, and customized technological services.

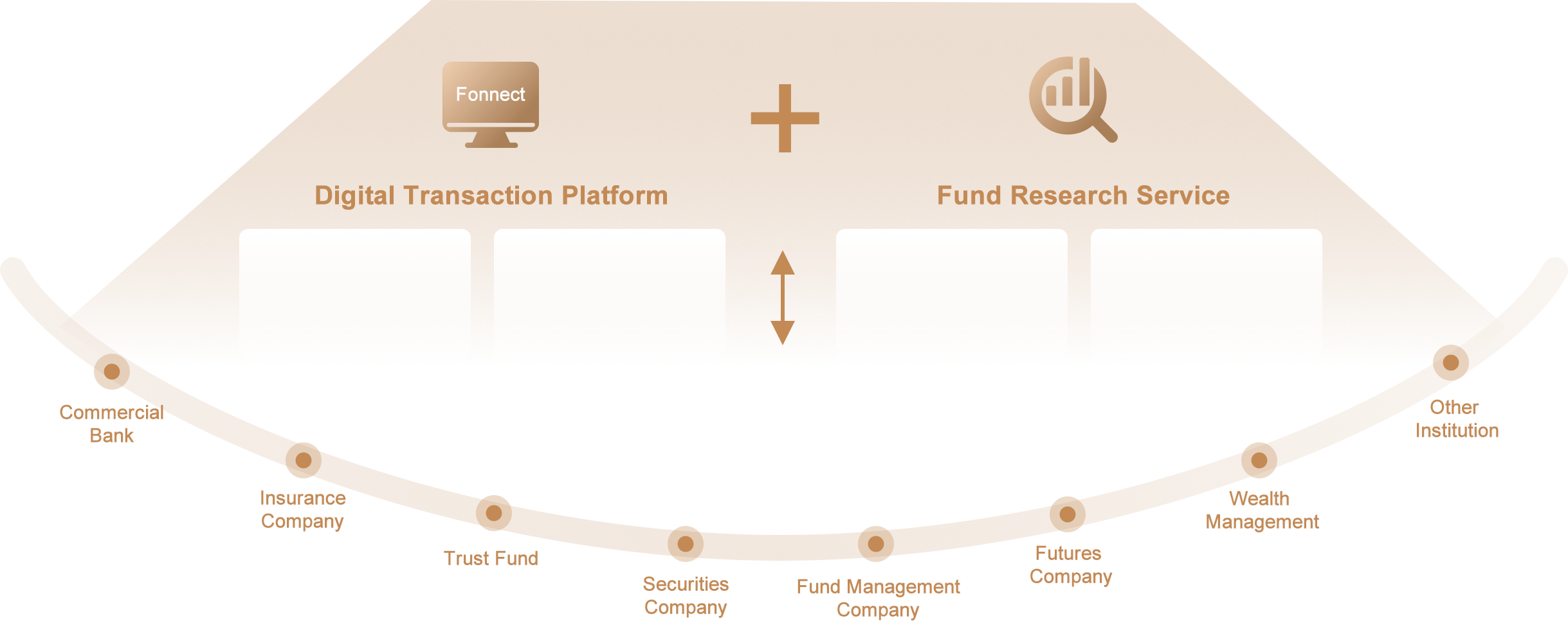

In 2016, we launched JGT (known as “基构通” in Chinese,which literally means “institutional funds connect”), a trailblazing digital fund investment platform for financial institutions. Setting a benchmark for the industry, JGT significantly enhances operational efficiency and contributes to the sustained, stable growth of the asset management sector. Currently, JGT serves over 500 diverse institutional clients, including banks, securities firms, trust companies, insurance companies, futures companies, and other financial institutions. It offers access to more than 150 fund houses and over 10,000 fund products (consolidated calculation of different fund share types) across mainland China. In 2023, FOFUND International (HK) Limited was founded in Hong Kong with the aim of promoting seamless cross - border investment. Through collaborations with global institutions, we strive to build a novel international business network, streamline and strengthen the integration between China and overseas capital markets.

Transaction Process: Offline, Manual, Paper-based

Compliance Process: Reliant on Manual Review

Human resources focused on repetitive tasks

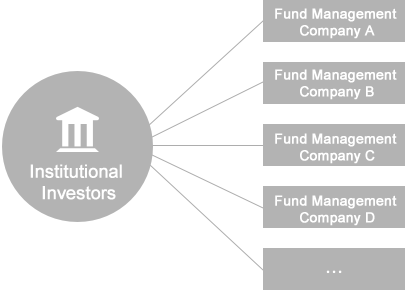

Limited Connectivity with Asset Managers

Traditional Model:

Compliance process: Digitalized

Reduced labor costs for operational roles

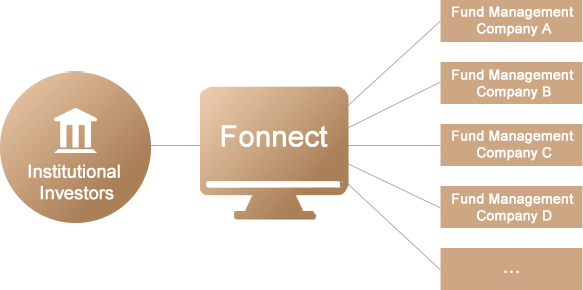

Multiplying connectivity with asset managers

Fund Management Company

Fund Products

Road Show

Investigate Summary

Serve financial institution clients

*Note: Different share classes of the fund are aggregated for statistical purposes.

As a licensed independent fund distributor dedicated to serving institutional investors, Fofund integrates years of profound institutional client resources with strong financial technology capabilities.In response to the evolving transformation of the asset management industry, we leverage real investment scenarios of institutional clients to enable fully digitalized fund transactions and provide customized research services and comprehensive solutions.

Focusing on

Institutional Investors

Understanding the True Needs

of Institutional Investors

in Fund Investments

Integrated

Comprehensive Service

Rapid Response to the Diverse

Needs of Institutional

Investors

Extensive Market

Resources

Empowering Institutional

Investors to Enhance

Investment Management Capabilities

Efficient Trading

Platform

Enhancing Institutional

Investors' Trading Efficiency and

Reducing Costs

Partners

We have established long-term and stable cooperative relationships with over 150 public fund management companies across the country.

Note: The above list includes only a selection of our partners, and no particular order is intended.

JGT(Fofund Investment Platform)

JGT(Fofund Investment Platform)  Fofund Research

Fofund Research